Why fleet operators are moving to 2290 e-file systems for tax compliance

Why fleet operators are moving to 2290 e-file systems for tax compliance

Blog Article

Everyone knows that you can have a wonderful time with family and friends when you go on vacation or travel to a new and distant spot. However, sometimes disaster can arise when things don't go quite as planned or anticipated. Here are some tips and hints that would help ensure that your getaway is affordable and trouble-free.

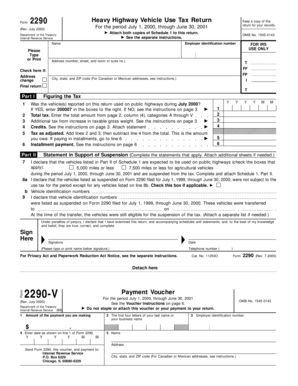

Time plays an important role in the trucking business. If you cannot meet your deadlines, there will be some sorely disappointed customers waiting on the other end. The filing of Form 2290 for trucks was usually done at the Internal Revenue Service office. In 2008, however, the electronic 2290 tax form form was introduced.

The Foreign Earned Income Exclusion allows an American expat to exclude up to $92,900 of income in 2011 using Form 2290 online 2555, with no tax on that income. The exclusion is for the amount of salary, bonus, commission, or other earned income earned for services outside the USA, up to the limit each year. This limit for 2011 is the number of days during a qualifying period that are in the tax year times $254.52 per IRS Form 2290 day.

Online and phone order transcripts usually arrive within 5 to 10 days of the IRS's receipt of your request. Mail-ordered transcripts can take up to 30 days.

I would like to go into the differences between a C corporation and an S corporation. C is the corporations we are most familiar with - corporate monsters like Microsoft, IBM, Disney, Sears, etc. These get IRS heavy vehicle tax at a corporate rate, which is currently 15% up to $50,000 in profit, and goes up from there. An S Corporation (S stands for Small) has to have less than 100 stockholders (among other requirements) but does NOT get taxed at the corporate level. Let me repeat that - no tax is paid on the corporation itself. Instead, the income gets reported on each shareholder's tax return, and is paid at their personal rate. This is usually the better deal for small companies, as personal returns are not taxed at all for the first $7000 in income.

Before operating the crane, operators should carefully read and understand the operation manual from the crane manufacturer. Further, they must always note any instructions given by a reliable instructor or operator. It is also crucial for the crane operator to understand the consequences of careless operation of cranes. They must be instructed of the proper use, prohibition and the safety rules and regulation during the operation.

Self-employed taxpayers have to file tax returns that report their income within three years of the date due to be eligible for Social Security credits for their retirement and avoid any income tax issues.